The fund could help you achieve short term goals

Quality portfolio and risk management framework may reduce overall credit risk

Aims to provide relative safety and regular income

Investment above three years enjoys Indexation benefit

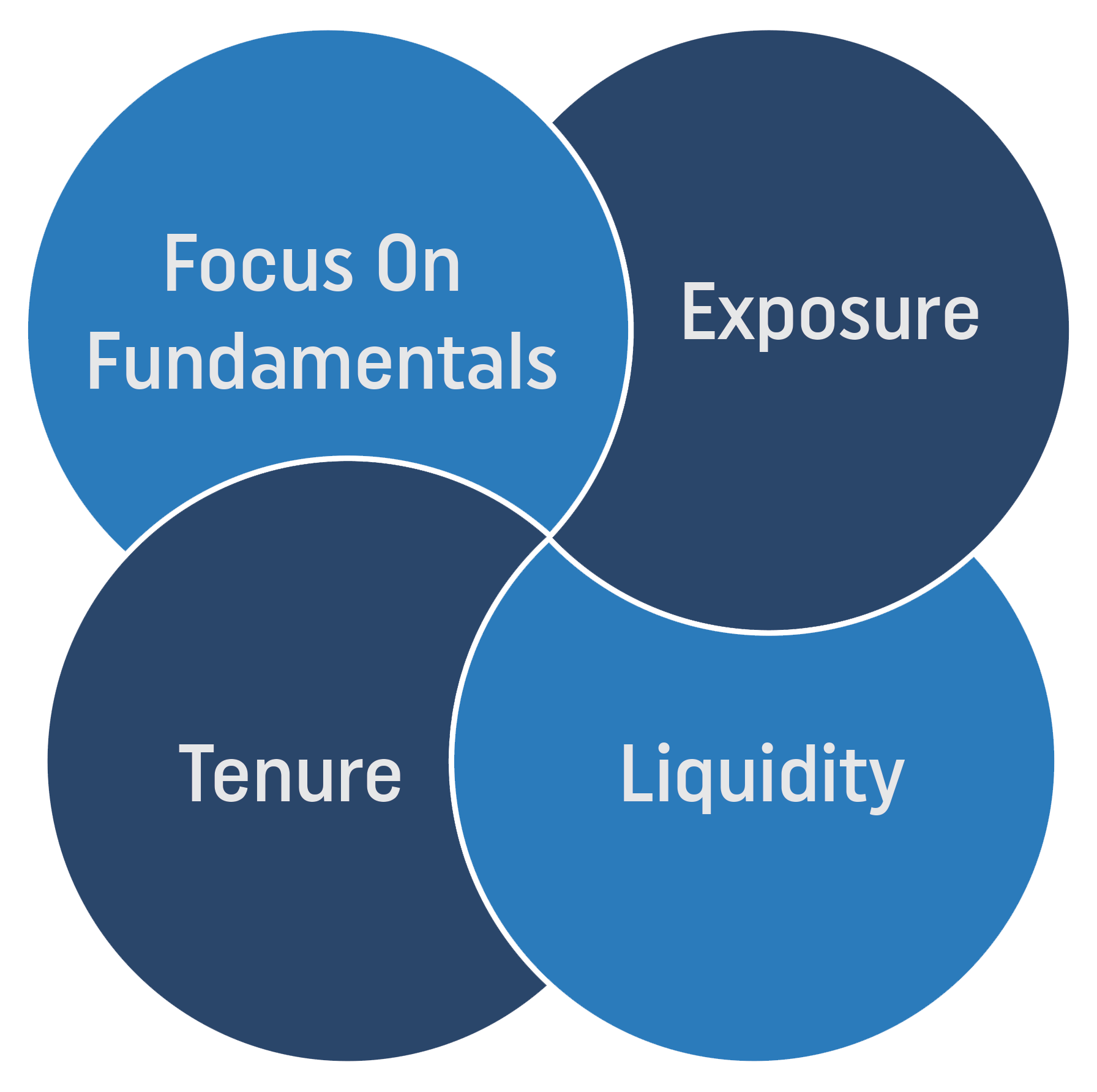

The Fund aims to take exposure to high-quality holdings making Tata Short Term Fund a relatively safe avenue

The fund aims to ensure adequate liquidity of the portfolio and position securities at the short end of the yield curve

The fund aims to generate income through Accrual strategy with low to moderate proportion of capital appreciation from rate movement

The fund focuses on fundamental research and objective analysis before taking any investment decision

The fund manager invests in securities with different tenures so that the fund is equipped to manage vagaries of the markets

The fund predominantly invests in good quality securities . It aims to select papers on the basis of qualitative and quantitative filters

The fund aims to ensure adequate liquidity of the portfolio and positions security on the low-yield curve to attain the same

Investors looking for regular savings in a debt fund irrespective of direction of interest rates

Investors seeking to build a quality portfolio of AAA/ A1+ papers

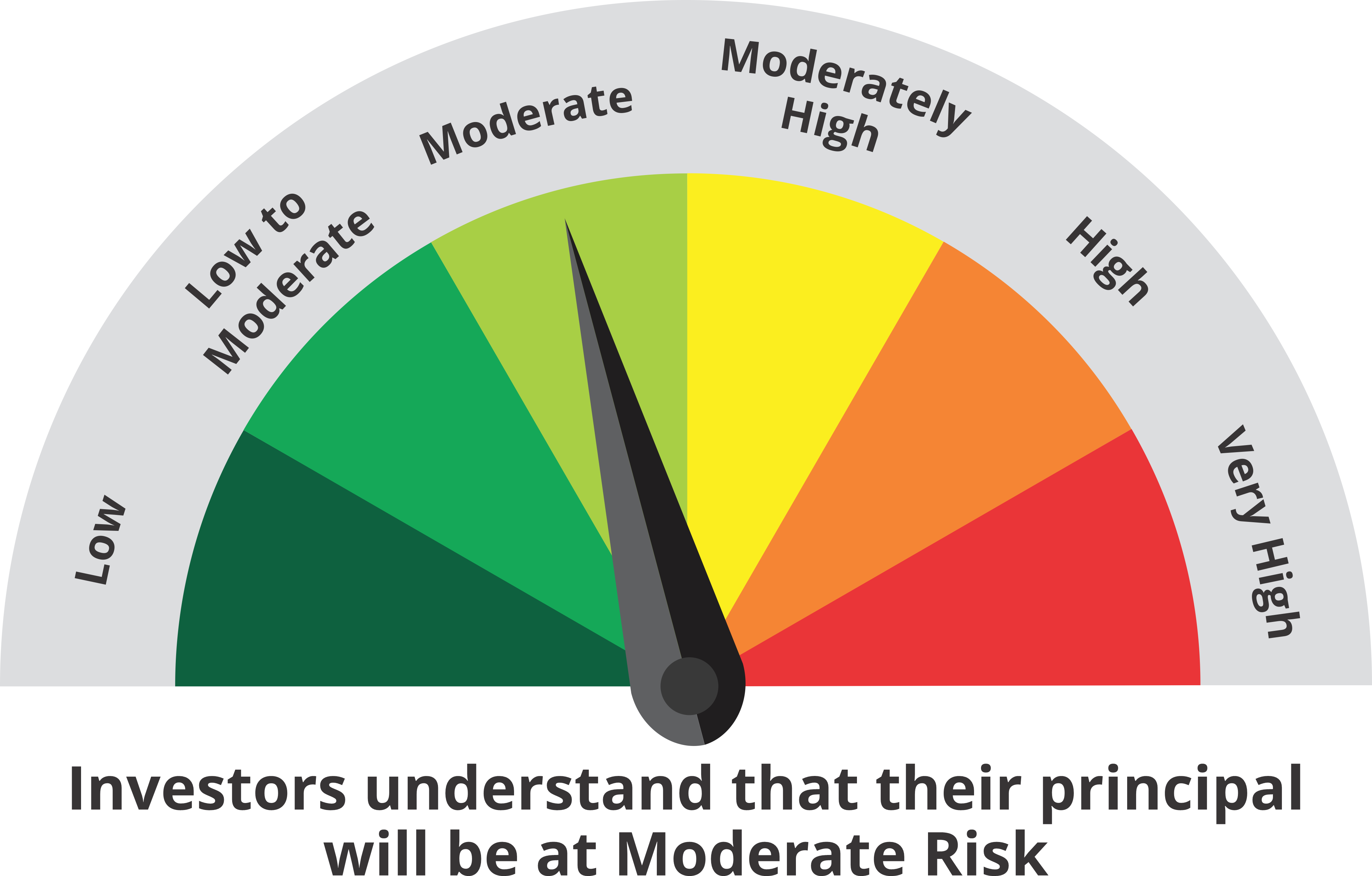

Investors with moderate risk appetite & willing to invest for a period of 1 year & above

| Scheme Name | Tata Short Term Bond Fund* |

| Investment Objective | The investment objective is to generate regular income/appreciation over a short term period. There can be no assurance that the investment objective of the Scheme will be realised. |

| Type of Scheme | An open ended short term debt scheme investing in instruments such that the Macaulay duration of portfolio is between 1 year and 3 years |

| Fund Manager | Murthy Nagarajan (Managing Since 1-Apr-17 and overall experience of 24 years) & Abhishek Sonthalia (Managing Since 06-Feb-20 and overall experience of 12 years) |

| Benchmark | Crisil Short Term Bond Fund Index |

| Min. Investment Amount | Rs. 5,000/- and in multiples of Re. 1/- thereafter |

| Load Structure | Entry Load: N.A Exit Load : Nil (w.e.f 24th January 2019) |

*The scheme has 1 segregated portfolio which was created under Tata Corporate Bond Fund.Main portfolio Tata Corporate Bond Fund was merged with Tata Short Term Bond Fund wef 14th December 2019

Tata Short Term Bond Fund is suitable for investors who are seeking*:

*Investors should consult their mutual fund distributor if in doubt about whether the product is suitable for them

Mutual fund investments are subject to market risks, read all scheme related documents carefully.

Corporate Office Address:

Tata Asset Management Private Limited, 19th floor, Parinee Crescenzo, ‘G’ Block, Bandra Kurla Complex, Opposite MCA Club, Bandra (E), Mumbai – 400051